The process of Closing the Income Statement in Navision or Business Central (or Year End as most of us normal mortals call it) creates a journal which debits all the income and credits all the expenses in the P&L and creates a balancing entry in the Balance Sheet, usually the GL for P&L Brought Forward.

Year End can be run as many times as you like which enables you to run it both at your actual Year End and after posting adjustments following an audit. The screenshots here are all taken from NAV 2019 but the commands, menus and principles are all the same in Business Central.

Go to “Accounting Periods” and highlight the last month of the financial year you wish to close

-

Click “Close Year”

- This locks the month end dates so that they cannot be altered

-

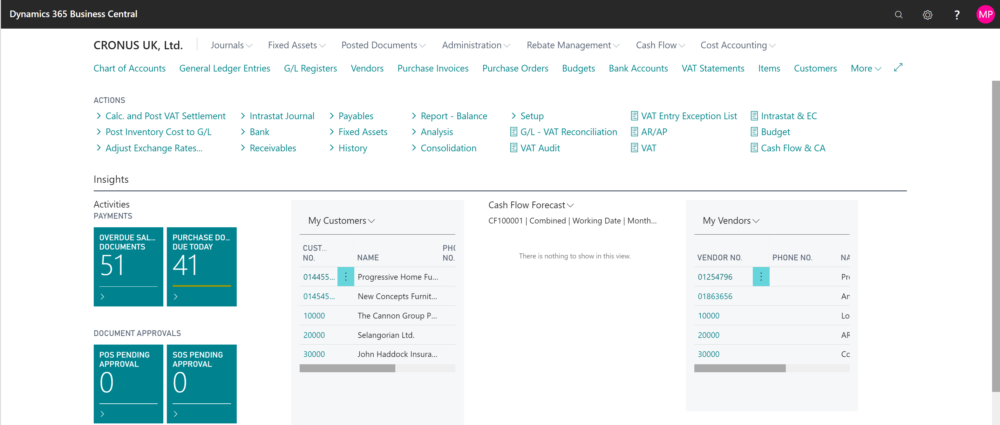

Now go to “General Journals” and create a new template as shown

- In Chart of Accounts click on “Close Income Statement” and fill in the pop up as shown

- In the “Document No” field fill in a doc no that will distinguish your year end postings from your other General Ledger postings.

- In the “Retained Earnings Acc” field, click the dropdown and chose the General Ledger (GL) code you want to save your retained earnings to (usually P&L Brought Fwd)

- Under “Posting Description” number the field so that you can distinguish between journals if you need to run it more than once

- Populate the “Dimensions” field with your default dimensions again, to allow for ease of navigation later. It’s important to remember to do this as failure to do so can lead to reporting problems down the line.

- Click “OK” and this will create the journal.

- Check the journal and post.

The journal has now been posted and is dated with the year end date prefixed with a C

This denotes a date – in the example shown – between 24:00 on 29/10/17 and 00:00 on 30/10/17 and can be used in filters

Steps 1 – 4 only need to be performed once each year. If you come to do a second year end (say after audit adjustments have been posted) then you can start at step 5.

Note: it’s useful to make a note of the last G/L Entry number so you can easily identify entries that have been posted back into the year after this process has been run.

I’m not a user of NAV, but know users through my Consulting so this blog may help me understand their terminology. One thing though what is a GL Code?

Good spot Paul! It’s a General Ledger code. Often referred to as a Nominal code on other systems

Love this. Excited for more blog posts

Aww…thanks Alison. Have no fear. I’ve got LOTS of material.

This is great, very well done.

Thanks Keegan!